Dental Insurance Verification form Guide. In the high-stakes environment of a modern dental practice, the front desk is often treated as a command center for a battle against paperwork. Phones ring, patients wait, and administrative staff find themselves trapped in a cycle of manual data entry and “hold” music. But what if the secret to a thriving practice wasn’t in how many claims you could process, but in how much time you could give back to your patients?

The shift toward a 10-45 minute insurance verification window is more than a technical upgrade; it is a cultural revolution. By streamlining dental insurance verification, your team can finally stop acting as debt collectors and start acting as care coordinators.

Dental Insurance Verification: The Domino That Knocks Down Your Entire Revenue Cycle

In the world of dental billing services, everything starts at the front desk. Think of your revenue cycle as a meticulously arranged row of dominoes. The very first tile—the one that dictates whether the rest fall in line or collapse in a mess—is what is dental insurance verification. When this step is flawed, the momentum of your practice grinds to a halt.

Why is it Important to Verify Coverage Under the Patient’s Plan?

Verifying coverage isn’t just about making sure a policy exists; it’s about understanding the nuances of the service billed. If you don’t know the specifics of a d6058 dental code (abutment supported porcelain/ceramic crown) or the frequency limits on a d1110 (prophylaxis), you are flying blind. To download the Offical ADA CDT’s Guide click here

-

The Financial Safety Net for Providers

-

Avoiding the “Unpaid Service” Trap:

Without verification, you risk performing complex procedures only to find the policy was terminated the week prior.

-

Accurate Treatment Planning: Real-time data allows you to present plans that the patient can actually afford.

-

Reducing Write-offs: Stop losing money on “estimated” coverage that turns out to be zero.

-

Optimizing Chair Time: Ensure that every slot in the schedule is filled by a patient with an active policy.

-

-

Building Unshakeable Patient Trust

-

Eliminating “Bill Shock”: Nothing ruins a patient relationship faster than an unexpected $500 bill.

-

Professionalism and Authority: When your front desk knows the benefits better than the patient does, it builds immediate clinical authority.

-

Transparent Financial Conversations: Use a dental insurance verification form to walk patients through their co-pays clearly.

-

Strengthening the Patient-Provider Bond: Patients feel cared for when their financial stress is managed proactively.

-

-

Streamlining the Workflow with 10-45 Minute Turnarounds

-

The “Golden Window” of Verification:

Verification should be fast enough to handle same-day additions but deep enough to catch exclusions.

-

Utilizing Dental Insurance Verification for Dental API:

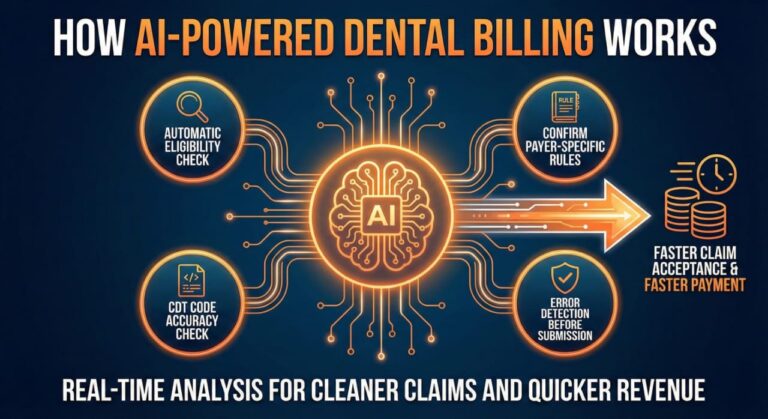

Modern tools allow for instant pings to payers, cutting hours of work into minutes.

-

Impact on Front Desk Morale:

Less time on hold means more time for meaningful patient interaction.

-

Scalability for Group Practices: Rapid verification allows remote dental billing companies to support multiple locations without bottlenecks.

-

Why Dental Insurance Verification is Critical to Your Payments—and Your Patients

If you treat verification as a secondary task, you are treating your revenue as a secondary concern. The integration of insurance verification for dental API and specialized dental insurance verification services ensures that the “financial check-up” is just as rigorous as the clinical one.

-

The Hidden Link Between Verification and Payment Speed

-

Clean Claim Submission: Dental insurance billing companies

know that 90% of denials are preventable at the front desk.

-

Faster Reimbursement Cycles:

A verified claim is a “rubber-stamped” claim in the eyes of the payer.

-

Minimizing the “Pending” Queue:

Reduce the time claims sit in “Review” by providing perfect eligibility data.

-

-

Patient Responsibility: The “Before” and “After”

-

Collecting at the Time of Service:

When you know the deductible is met, you can collect the co-pay immediately.

-

Defining the D0150 Dental Code Definition for Patients:

Explain why their “comprehensive oral evaluation” is covered (or why it’s not) before they leave the chair.

-

Encouraging Same-Day Treatment: Instant verification makes it easy for a patient to say “yes” to a crown on the spot.

-

-

Preventing the “Reschedule” Nightmare

-

Identifying Inactive Policies Early:

Catching a lapsed policy 24 hours before the visit saves an empty chair.

-

Managing Complex Referrals: Knowing who to refer complex dental cases to based on their specific network benefits.

-

Reducing No-Shows: Patients are more likely to show up when they know exactly what their out-of-pocket cost will be.

-

Why Dental Insurance Verification is Critical to Your Payments—and Your Patients

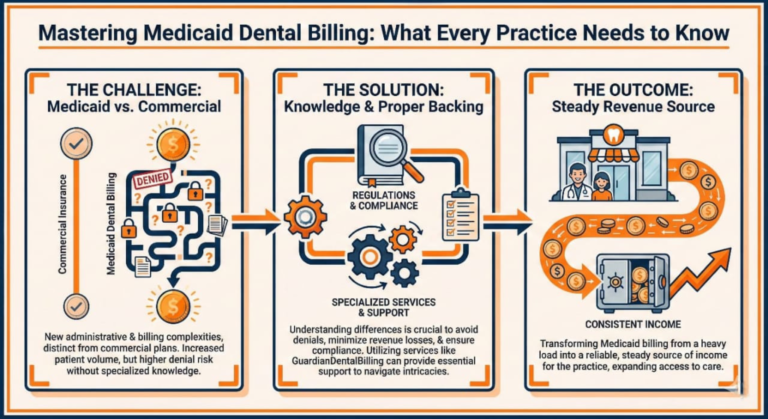

When the front office focuses on “just getting the claim out” rather than “getting the patient’s data right,” the practice enters a state of financial reactive management. True dental insurance billing starts long before the dentist picks up a handpiece. It begins with the realization that every unverified patient is a potential $0.00 reimbursement.

What are Some Potential Consequences of Failing to Verify Insurance?

Failure to verify is the single greatest leak in a dental practice’s bucket. It doesn’t just result in a letter from an insurance company; it erodes the very foundation of the practice’s profitability and reputation.

-

The Financial Bleed: Denials and Write-Offs

-

The Rise of Inactive Policy Denials: Patients often assume their coverage is active simply because they still have their old card. If you bill a procedure under an inactive plan, the claim is rejected instantly.

-

Absorbing the Cost of Major Procedures: For complex cases like a d6058 dental code, the laboratory fees alone are significant. If insurance doesn’t pay, and the patient can’t, the practice takes the hit.

-

Increased Accounts Receivable (A/R) Days: Every denial adds an average of 30–60 days to your payment cycle.

-

The “Silent” Loss of Appeals:

Many practices lack the time to appeal denials caused by eligibility errors, leading to thousands of dollars in “lost” revenue that is eventually written off.

-

-

Operational Chaos and Staff Burnout

-

The “Double Work” Trap: Failing to verify means your team has to do everything twice—once to submit, and once to fix the mess.

-

High-Stress “Check-Out” Confrontations: When a patient is told they owe $200 more than they expected, the front desk bears the brunt of that anger.

-

Inefficient Use of Chair Time: If a patient cancels because they can’t afford a surprise bill, that chair sits empty, costing the practice hundreds per hour.

-

Decreased Staff Retention: Administrative teams are 40% more likely to quit when they feel they are “always fighting with insurance” rather than helping patients.

-

-

Erosion of Patient Trust and Retention

-

The “Bait and Switch” Perception: Patients view inaccurate estimates as a lack of transparency, often leaving negative Google reviews that damage your brand.

-

Postponed Essential Treatment: Fear of “surprise bills” causes patients to delay necessary care, leading to worse clinical outcomes

-

Loss of Word-of-Mouth Referrals: Patients don’t refer friends to offices where the billing is “confusing.”

-

What are the Most Common Data Entry Errors in Insurance Verification?

Even with the best intentions, human error is inevitable in manual systems. Understanding the anatomy of a mistake is the first step toward preventing it.

The “Identity Crisis”: Basic Information Errors

-

-

Typographic Errors in Policy Numbers:

A single digit wrong in the Subscriber ID is enough for an “Individual Not Found” response.

-

Name Mismatches:

Does the insurance system have “Jonathan” while your PMS says “John”? This is a frequent cause of auto-denials.

-

Date of Birth Discrepancies:

Swapping a month and day for a dependent can lead to a full claim rejection.

-

Relationship to Subscriber Mistakes:

Listing a spouse as “Self” or a child as “Subscriber” creates a coordination of benefits nightmare.

-

-

The “Coverage Gap”: Plan Specifics and Exclusions

-

Missing the “Missing Tooth Clause”:

If a tooth was extracted before the plan was active, treatments like bridges or implants (e.g., d6058) might be excluded.

-

Overlooking Frequency Limitations:

Many plans only cover a d1110 (prophylaxis) twice per calendar year. Billing a third results in zero payment.

-

Ignoring Waiting Periods:

New policies often have a 6–12 month waiting period for major restorative work.

-

Annual Maximum Exhaustion:

If the patient saw an oral surgeon earlier in the year, they may have $0.00 left in their annual maximum.

-

-

Where and When These Errors Typically Happen

-

The Rushed “Same-Day” Add-In:

Verification is often skipped for emergency walk-ins to “save time.”

-

The “Assumption” Error:

Assuming that because a patient has been coming for 5 years, their insurance hasn’t changed.

-

The “Multi-Tasking” Distraction:

Taking insurance info over the phone while checking in another patient leads to scribbled, inaccurate notes.

-

The Data Transfer Gap:

When info is written on paper and then typed into the Open Dental or EagleSoft system later.

-

How Do You Verify Patient Eligibility and Benefits?

A systematic approach is the only way to ensure 99% claim acceptance. Below is the blueprint for a modern, 10-45 minute verification workflow.

-

Step-by-Step Guide for Eligibility Verification

-

Initial Data Intake:

Collect the full legal name, DOB, Subscriber ID, and Employer Name at the time of booking.

-

Automated Real-Time Check:

Use an insurance verification for dental API to get an instant “Active/Inactive” status.

-

The Deep Dive (Payer Portals):

Log in to the carrier portal to check specific codes like d0150 (comprehensive evaluation) and frequency limits.

-

Documentation:

Upload a PDF of the benefits summary directly into the patient’s digital chart for future reference.

-

The Patient Confirmation Call:

If a deductible is owed, call the patient 48 hours before the visit to discuss their responsibility.

-

-

Key Best Practices for Patient Insurance Verification

-

The “Verify Every Time” Rule:

Treat every appointment as a new insurance event, regardless of how long the patient has been with you.

-

Use a Standardized Dental Insurance Verification Form:

Ensure every staff member asks the same 15 questions to every carrier.

-

Establish “Ownership” of the Process:

Assign one person (or an external dental insurance billing company) to own the data quality.

-

-

When to Check Patient Eligibility?

-

The 72-Hour Rule:

Verify all scheduled patients 3 days in advance to allow time to contact them if there are issues.

-

The Check-In Double Check:

Re-confirm the Member ID at the window to ensure nothing changed between the call and the visit.

-

Post-Treatment Adjustments:

If a treatment plan changes mid-procedure, a quick re-verification prevents billing errors.

-

This is Part 3 of 4. Here, we move into the solutions and the specific “dictionary” of knowledge your team needs to act as experts. We also address how modern practice structures like MSOs (Management Services Organizations) are solving the verification crisis.

Your Easiest Fix: Let Professionals and Technology Manage Your Dental Insurance Verification

For many practices, the burden of staying on top of every inactive policy and d1110 dental code frequency is simply too high for a busy front desk. The “easiest fix” isn’t just working harder—it’s working smarter by leveraging specialized dental insurance verification services and modern organizational structures.

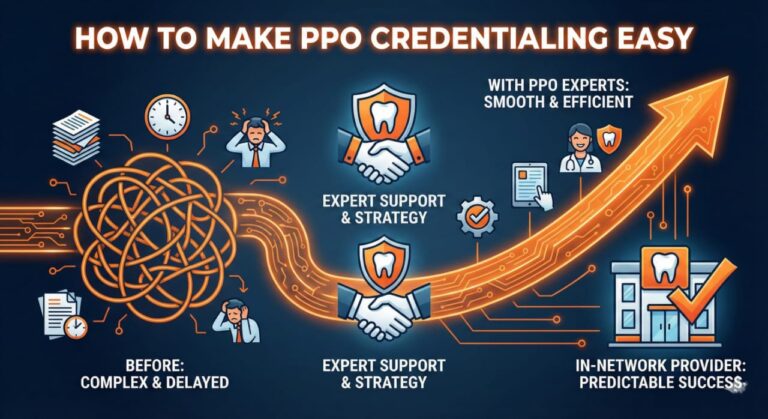

MSOs and the Role of Management Services Organizations

The rise of the MSO model and similar Management Services Organizations has changed the game for independent practices. By separating clinical care from administrative “heavy lifting,” MSOs allow dentists to focus on the chair while experts handle the revenue cycle.

-

What is an MSO and How Does it Help?

-

Centralized Billing and Verification:

MSOs consolidate the verification process for multiple offices, ensuring a high level of expertise that a single front-desk hire might not possess.

-

Economies of Scale:

Access to high-end insurance verification for dental API tools that might be too expensive for a solo practitioner.

-

Compliance and Security:

MSOs ensure that all data handling meets the latest HIPAA and state-specific regulatory standards.

-

Consistent Revenue Flow:

By removing the “human error” variable from the front office, MSOs create predictable, steady collections.

-

-

The Power of Dental Insurance Billing Companies

-

Real-Time Eligibility Checks:

These companies don’t just “check” insurance; they verify it in the “golden window” of 10-45 minutes.

-

Specialized Coding Knowledge:

Experts who understand exactly when to use a d0150 dental code definition versus a periodic exam code.

-

Denial Management:

If a claim is denied despite verification, these services handle the complex appeal process so your staff doesn’t have to.

-

Advanced Reporting:

Get insights into your practice’s “clean claim rate” and identify where bottlenecks are happening.

-

-

Remote Dental Billing Companies: The “Invisible” Front Desk

-

Seamless Integration with Open Dental:

Many remote dental billing companies work directly within your existing software, updating patient files in real-time.

-

24/7 Verification Cycles:

While your office is closed, remote teams can verify the next day’s schedule, so your team walks into a “ready-to-go” morning.

-

Cost-Effectiveness:

Outsourcing often costs less than the salary, benefits, and training of a full-time in-house insurance coordinator.

-

Essential Insurance Terms Every Front Desk Staff Should Know

To manage the “Power of 10-45 Minute Verification,” your staff must speak the language of the payers. Without a firm grasp of these terms, mistakes in dental insurance verification are inevitable.

-

The Basics of Eligibility and Policy Status

-

Active Coverage vs. Inactive Policy:

A policy is “Active” only if the premium is paid up to the date of service. An inactive policy is the #1 cause of immediate claim rejection.

-

Effective Date:

The specific date coverage begins. Many new employees wait for their “90-day” mark before dental kicks in.

-

Termination Date:

The day coverage ends—critical to check for patients who have recently changed or lost jobs.

-

Subscriber vs. Beneficiary:

Understanding who “owns” the plan versus who is receiving the treatment (spouse/child).

-

-

Financial Responsibility and Out-of-Pocket Costs

-

Deductible (Individual vs. Family):

The amount the patient must pay before the insurance pays a cent.

-

Coinsurance (The 100/80/50 Rule):

Most plans cover 100% of preventive (like d1110), 80% of basic, and 50% of major (like d6058).

-

Annual Maximum:

The total dollar amount the plan will pay in a benefit year. Once this is hit, the patient is 100% responsible.

-

Coordination of Benefits (COB):

The rules that determine which insurance pays first when a patient has dual coverage.

-

-

Procedural Clauses and “Hidden” Rules

-

Frequency Limitations:

For example, insurance may only cover a d0150 once every three years.

-

Missing Tooth Clause:

A rule stating the plan won’t pay for a replacement (bridge/implant) if the tooth was lost before the policy started.

-

Downgrade (Alternate Benefit):

When an insurance company only pays for the “cheapest” version of a procedure (e.g., paying the price of a silver filling for a tooth-colored one).

-

Waiting Periods:

A 6-12 month delay on “Major” services for new policyholders.

-

Eligibility Verification and Your Front Office

The goal of the front office should be to transition from “collecting info” to “verifying eligibility.” The difference is subtle but vital for your dental billing services.

-

Establishing a “Culture of Verification”

-

The “3-Day” Rule:

All patients for Wednesday must be verified by Monday afternoon.

-

Standardizing the Intake:

Using a uniform dental insurance verification form ensures no one forgets to ask about “Missing Tooth Clauses.”

-

Empowering the Patient:

Teaching the front desk to say, “Your insurance covers 80%, so your portion today is $X,” rather than “We’ll bill you later.”

-

This is Part 4 of 4. In this final section, we synthesize the technical workflow, provide a high-level summary of the practice transformation, and conclude with the most frequently asked questions to ensure your article captures “Featured Snippet” opportunities on Google.

The Step-by-Step Guide for Eligibility Verification: Mastering the 10-45 Minute Window

To achieve a seamless revenue cycle, your team needs a repeatable “algorithm” for success. Whether you are an independent office or working with dental insurance verification companies, these steps ensure nothing falls through the cracks.

The Process of Insurance Verification Improved by Medical Billing Outsourcing

Outsourcing to specialized dental insurance billing companies doesn’t just remove the workload—it optimizes the accuracy of every step. Here is the workflow that the most successful practices use to maintain a 98% clean claim rate.

-

Phase 1: Pre-Appointment Intake

-

Capturing the Basics:

Secure the full name, DOB, and Subscriber ID. Ask, “Has your employer or insurance changed since your last visit?”

-

The Digital Bridge:

If the patient is new, send a digital dental insurance verification form via text or email before they arrive.

-

Identifying Secondary Coverage:

Always ask if the patient is covered under a spouse’s plan to prevent Coordination of Benefits (COB) denials later.

-

-

Phase 2: The 10-45 Minute Verification Deep Dive

-

Instant API Check:

Run the patient through your insurance verification for dental API (like the one integrated into Open Dental) for an immediate active/inactive ping.

-

Specific Code Verification:

Check for high-value codes. Does the plan cover a d6058 dental code? What is the specific d0150 dental code definition for this payer?

-

History and Frequency Tracking:

Check when the last d1110 was performed at any office, not just yours.

-

Calculating the Deductible:

Verify if the deductible is “Calendar Year” or “Plan Year” and how much has been met to date.

-

-

Phase 3: The Treatment Room Integration

-

Live Benefit Updates:

Ensure the clinical team sees the verified benefits in the software before they present a treatment plan.

-

Handling Complex Cases:

Know who to refer complex dental cases to if the insurance requires a specialist for certain surgical procedures.

-

Pre-Authorizations:

For major work, submit a “Pre-D” (Pre-Determination) immediately after verification to lock in the estimate.

-

Does Open Dental Offer Insurance Verification?

One of the most common questions from office managers is about software capability. Open Dental and similar platforms have evolved to support this 10-45 minute goal through integrated e-services.

-

Leveraging Open Dental E-Services

-

Real-Time Eligibility (RTE):

This allows the front desk to get a snapshot of benefits in seconds without picking up the phone.

-

Benefits of the Integrated Approach:

RTE data flows directly into the patient’s “Insurance Benefits” screen, reducing manual entry errors.

-

Limitations to Consider:

While software is great for “Active/Inactive” status, it may not catch “Missing Tooth Clauses” as accurately as a human expert from a remote dental billing company.

-

Summary: Transforming Your Front Desk from “Processors” to “Patient Advocates”

The shift toward rapid, accurate dental insurance verification is the hallmark of a modern, patient-centric practice. By focusing on the 10-45 minute verification window, you remove the administrative friction that leads to “bill shock,” staff burnout, and revenue leakage.

When you use dental insurance verification services or a Medcare MSO model, you aren’t just “outsourcing”—you are investing in the patient experience. Your front desk can finally look a patient in the eye, provide a guaranteed estimate for a d6058 crown, and focus on care, while the “dominoes” of your revenue cycle fall perfectly into place.

Frequently Asked Questions (FAQ)

-

What is the difference between a D1110 and a D0150 dental code?

The distinction between the D1110 and D0150 dental codes is crucial for effective dental insurance verification. The D1110 code pertains to routine prophylaxis, aimed at maintaining oral health through preventive cleaning, while the D0150 code encompasses a thorough oral evaluation, which is – particularly relevant for new patients or those who have not received dental care within the past three years.

Given the frequency limitations imposed by various insurance plans, it is imperative for front desk staff to conduct meticulous dental insurance verification to ensure appropriate billing and maximum reimbursement for the services rendered. This focus not only enhances patient satisfaction but also streamlines the administrative workflow within the practice.

-

Why should I use a dental insurance billing company instead of doing it in-house?

Utilizing a dental insurance billing company allows for specialized expertise in dental insurance verification, ensuring that claims are processed with precision. This dedicated focus minimizes the potential for errors that can arise when in-house staff juggle multiple responsibilities, such as patient interactions and administrative tasks. As a result, practices can experience accelerated payment cycles and enhanced cash flow, while front desk personnel are freed to prioritize patient care and service, ultimately improving overall patient satisfaction. Transitioning to a billing company can transform the efficiency of your practice, making it more effective in managing insurance claims.

-

Do insurance companies require student verification for dental coverage?

Furthermore, the necessity for dental insurance verification becomes even more pronounced when navigating these various plan stipulations. While the majority of contemporary plans provide broader coverage for adult dependents, understanding the nuances of older plans is crucial to ensure that all eligible members receive the appropriate benefits. This verification process not only aids in determining eligibility but also plays a critical role in streamlining the claims process, ultimately allowing front desk staff to dedicate more time to patient care rather than administrative tasks. By prioritizing accurate verification, practices can enhance operational efficiency and patient satisfaction.

-

What happens if we fail to verify insurance before a d6058 procedure?

Most remote dental billing companies utilize secure, HIPAA-compliant VPNs or remote desktop software to seamlessly access your practice management system, such as Open Dental, for efficient dental insurance verification. This approach allows them to update your records in real-time, ensuring that your in-office team can view verified information immediately. By prioritizing dental insurance verification, practices can mitigate financial risks associated with high-cost procedures like the d6058, safeguarding revenue and enhancing patient care. Ultimately, focusing your front desk’s efforts on patient interactions rather than claims processing can lead to improved operational efficiency and patient satisfaction.

-

How do remote dental billing companies access my data?

Most remote dental billing companies use secure, HIPAA-compliant VPNs or remote desktop software to work directly within your practice management system (like Open Dental). They update your records in real-time so your in-office team sees the verified info instantly. The seamless integration provided by these technologies ensures that all claims and patient information remain confidential and protected. By allowing remote billing specialists to access your data securely, practices can streamline workflows and enhance overall efficiency.

This enables front desk staff to concentrate on patient interactions rather than being bogged down by administrative tasks related to insurance verification. Moreover, the timely updates from billing specialists reduce the risk of errors and delays in processing claims. Ultimately, this collaborative approach fosters a more patient-centered environment within the practice, leading to improved patient satisfaction and retention.

Related Frequently Asked Questions (FAQ)

What is dental insurance benefit verification eligibility and benefit?