The Definitive Guide to Endodontic Billing: Strategies for a 98% Clean Claims Rate

Introduction: Why Specialized Endodontic Billing is a Different Beast

In the high-precision world of dental specialties, Endodontics stands alone. While a general practitioner might manage a steady stream of cleanings and fillings, an Endodontist deals with high-stakes, high-value procedures where every single claim carries significant weight. In this environment, Endodontic billing isn’t just an administrative task; it is the heartbeat of the practice’s financial health.

For over 13 years, I have navigated the labyrinth of Revenue Cycle Management (RCM). What I have discovered is a startling reality: many Endodontic practices are losing between 15% and 20% of their potential revenue due to “lazy” billing. When I talk about lazy billing, I am referring to the “submit and pray” method—where claims are sent without proper narratives, attachments, or verification, leading to a cycle of denials that chokes cash flow.

At Guardian Dental Billing, our philosophy is different. We don’t just “process” claims; we “engineer” them. To reach a 98% clean claims rate, you have to understand the clinical nuances behind the CDT codes. You have to know why a Molar RCT (D3330) is being scrutinized differently than a Bicuspid (D3320). This guide is designed to pull back the curtain on the elite strategies we use to keep AR under 90 days and ensure our clients see zero pending claims in the dreaded 90+ day category.

The Economic Impact of “Standard” vs. “Specialized” RCM

The difference between a general billing company and an Endodontic billing specialist is measurable in dollars and cents. A generalist might see a denial and wait for the monthly aging report to address it. A specialist, however, treats a denial like a clinical emergency.

The Cost of the “Wait and See” Approach

Consider the average cost of an Endodontic procedure. If your practice is producing $150,000 a month but your “Net Collection” rate is only 82%, you are leaving $27,000 on the table every single month. Over a year, that is over $300,000. In most cases, this “missing” money isn’t actually lost—it’s just stuck. It’s stuck in “Requested Information” folders, stuck in “Incorrect Subscriber ID” loops, or stuck because a clinical narrative didn’t explicitly state why the root canal was medically necessary.

The 10-45 Minute Rule: Why Verification is the First Step to a Clean Claim

You cannot have a clean claim without a clean start. One of the biggest bottlenecks in specialized billing is the insurance verification process. Most offices settle for a “breakdown of benefits” that is three days old. We operate on a 10–45 minute turnaround time (TAT) for insurance verification.

Why does this matter for your clean claim rate? Because insurance data changes in real-time. If a patient reached their annual maximum at a general dentist’s office yesterday, and you perform a $1,200 RCT today without real-time verification, that claim is dead on arrival. By securing the most current data before the patient even enters the operatory, we eliminate the #1 cause of insurance denials before the claim is even created.

The Technical Deep Dive: Master Coding and Clinical Narratives

In Endodontic billing, the CDT (Current Dental Terminology) code is merely a placeholder. The real “meat” of the claim lies in the supporting evidence. If you want to maintain a 98% clean claims rate, you must stop treating billing as a clerical data-entry task and start treating it as a forensic presentation of clinical facts.

Decoding the D3330 Battleground

The Molar Root Canal Treatment (D3330) is the highest-volume procedure for most specialists, yet it is also the most scrutinized by insurance adjusters. Why? Because it carries the highest reimbursement rate. Insurance carriers use automated algorithms to flag these claims for manual review, looking for any excuse to “downcode” or deny.

To bypass these hurdles, our methodology involves three non-negotiable pillars:

-

The Radiographic Standard: A “grainy” X-ray is a guaranteed denial. We ensure that every claim includes a crystal-clear pre-operative periapical (PA) showing the full extent of the pathology (such as periapical lucency) and a post-operative PA showing a dense, three-dimensional obturation to the apex.

-

The “Medical Necessity” Narrative: Simply stating “patient had a toothache” is no longer enough. We train our teams to extract specific clinical terminology from the doctor’s notes. Phrases like “Symptomatic irreversible pulpitis with radiographic evidence of widened PDL” provide the adjuster with the clinical justification they need to hit the “Approve” button immediately.

-

The Multi-Canal Distinction: If a molar has an unusual anatomy—such as a difficult-to-locate MB2 canal—we document the time and specialized equipment (like an operating microscope) used to negotiate it. This not only justifies the D3330 but protects the practice in the event of an audit.

Navigating “Red Flag” Codes: D3331, D3332, and D3333

While D3330 is the bread and butter, specialty codes like D3331 (Treatment of root canal obstruction), D3332 (Incomplete endodontic therapy), and D3333 (Internal root repair) are often viewed as “Red Flags” by insurance companies. They frequently attempt to bundle these into the global fee of the RCT.

Achieving zero pending claims in the 90+ days category requires a proactive stance on these codes. We don’t just “send and hope.” We include a separate “Specialty Narrative” for these codes. For instance, if a doctor is performing a D3333 to repair a perforation, the narrative must explain that this was a separate, distinct procedure from the cleaning and shaping of the canals. By isolating these complexities, we prevent the entire claim from being “pended” for 30 days while the insurance company “thinks” about it.

The Humanized Narrative: Speaking the Adjuster’s Language

Most AI-generated billing notes are easy for insurance algorithms to spot—they are repetitive and vague. To ensure a human-centric approach, we focus on “Clinical Storytelling.”

-

Weak Narrative: “Root canal needed due to decay.”

-

Guardian Narrative: “Patient presented with acute periradicular periodontitis. Clinical exam revealed a deep distal-occlusal carious lesion approximating the pulp chamber. Treatment required ultrasonic negotiation of calcified canals to achieve apical patency.”

Which one do you think an insurance medical director is more likely to approve without asking for more notes? The latter. This level of detail is exactly how we keep our AR Management goals on track, ensuring that the “money in the books” becomes “money in the bank.”

This is Episode 3: Software Mastery—Turning Endovision and Dentrix into Revenue Engines. We are now moving into the operational heart of the practice to ensure your digital tools are working for you, not against you.

The Digital Backbone: Optimizing Specialized Software for Maximum ROI

In the realm of Endodontic billing, your practice management software (PMS) is either a bridge to profitability or a roadblock of data silos. Most general dental practices are comfortable with the basics of Dentrix or Eaglesoft, but an Endodontic specialist often requires the surgical precision of Endovision or specialized modules within Dentrix Enterprise.

The Endovision Edge: Specialist-Specific Workflow

Endovision is built for the “specialty” workflow, yet many offices only use about 30% of its billing capabilities. To achieve a 98% clean claims rate, you cannot rely on default settings.

At Guardian Dental Billing, we focus on three critical software optimizations:

-

Automated Attachment Mapping: We configure the system to prompt for X-rays and narratives the moment a D3330 or D3410 is posted. This prevents the “I’ll do it later” mentality that leads to claims being sent without necessary documentation.

-

Ledger Integrity and “Real-Time” Posting: One of the biggest drains on a practice is the “lag” between insurance payment and ledger posting. We utilize Endovision’s electronic EOB (ERA) integration to post payments daily. This ensures your AR Management reports are never based on outdated data.

-

Referral Tracking for Revenue Growth: Unlike general dentistry, Endodontists rely on a network of referring GPs. We use the software’s reporting tools to track which referrals result in the highest “Claim Success” rates. This isn’t just billing; it’s business intelligence.

Dentrix and Open Dental: Bridging the General-Specialist Gap

If your practice uses more mainstream software like Dentrix Ascend or Open Dental, the challenge is customization. These platforms are designed for the masses. To make them work for Endodontic billing, you have to “specialize” the setup.

-

Custom Claim Forms: We create custom “Specialty Claim” templates that automatically include the “Ordering Provider” information (the referring GP), which is a common reason for Endodontic claim rejections.

-

The “Clean Claim” Audit Trail: We use the internal “Notes” system to create a digital paper trail for every follow-up. When we say we keep zero pending claims in the 90+ days category, it’s because our team is in the software every 48 hours, touching every outstanding claim and documenting the conversation with the insurance rep. This human touch, combined with software speed, is the secret sauce.

Beyond Data Entry: The “Plug-and-Play” Integration

The most common pain point I hear from CEOs and Practice Owners is: “I don’t have time to train a biller on my software.” This is where a professional RCM partner proves their worth. Our team arrives with “Software Mastery.” Whether it is Oryx, Curve Hero, AbelDent, CareStack, or Denticon, we don’t ask for a manual—we ask for a login. By functioning as a “plug-and-play” extension of your office, we eliminate the 3-month “learning curve” that usually results in a dip in collections during staff transitions.

Real-Time Insurance Verification: The 10–45 Minute Standard

Software isn’t just for billing; it’s for “pre-veting.” We utilize API integrations and direct-to-carrier portals to maintain a 10–45 minute insurance verification TAT. By the time your patient has filled out their digital intake form, their benefits are already verified and synced into your software’s treatment planner. This eliminates the “financial surprise” at the front desk and sets the stage for a clean, undisputed claim submission.

This is Episode 4: Aggressive AR Recovery—The “Zero 90+ Day” Strategy. We are now diving into the “war room” of your financial operations, moving past submission and into the aggressive pursuit of revenue.

The Hunt for Revenue: Aggressive AR Management and Denial Reversal

In Endodontic billing, submitting a claim is only 50% of the job. The remaining 50%—and where most practices fail—is the follow-up. Insurance companies thrive on “administrative friction.” They bank on the fact that your office staff is too busy with patients to stay on hold for 45 minutes to find out why a $1,200 RCT was denied.

This is where the “Guardian” approach turns the tables. To maintain zero pending claims in the 90+ days category, you have to stop being passive and start being persistent.

The “48-Hour Touch” Rule

Most billing services check their “Aging Report” once a month. This is a fatal mistake in specialty RCM. By the time a claim is 30 days old, the trail is already getting cold.

Our strategy is built on a 48-hour touch cycle. If a claim has not been acknowledged by the clearinghouse within 48 hours, we investigate. If a claim is “pended” for more info, we don’t wait for the letter in the mail; we pull the requirement from the insurance portal and fulfill it immediately. This aggressive stance is how we achieve a 98% clean claims rate. We don’t give the insurance company time to breathe.

Denial Reversal: The Clinical Counter-Attack

Denials in Endodontics are rarely about “missing data”; they are usually about “interpretation.” When a carrier denies a D3330 claim stating “Endodontic therapy not indicated,” they are challenging the doctor’s clinical judgment.

A general biller will usually just “re-submit” the same claim, hoping for a different result. We execute a Clinical Counter-Attack:

-

Level 1 Appeal: We draft a specific rebuttal using the doctor’s original intraoral photos and preoperative X-rays.

-

The “Peer-to-Peer” Threat: If a high-value claim is denied twice, we demand a Peer-to-Peer review with an actual Endodontist employed by the insurance company.

-

The Result: Because we speak the clinical language of “apical periodontitis” and “irreversible pulpitis,” we overturn 90% of denials on the first appeal. This is the difference between “billing” and “Revenue Cycle Management.”

Managing the “90-Day Ghost”

Claims that sit in the 90+ day bucket are essentially “zombie revenue.” The older they get, the less likely they are to be paid. To keep this bucket at zero, we perform a weekly “Deep Clean.”

We don’t just call on these claims; we escalate them. We use the 10–45 minute insurance verification TAT data from the initial visit to prove to the carrier that they had already authorized the treatment. When you have a digital “paper trail” that starts before the patient even enters the chair, the insurance company has no leg to stand on. This level of accountability is what keeps your practice profitable and your cash flow predictable.

Transparency Through Reporting: The Friday “Pulse”

How do you know your Endodontic billing partner is actually working? Through radical transparency. Every Friday, we provide a “Pulse Report” that doesn’t just show numbers, but actions.

-

Claims Sent: Total volume vs. value.

-

Denials Overturned: The dollar amount we “rescued” that week.

- The 90+ Zero Check: A confirmation that every single claim in the aging bucket has been “touched” and has a scheduled follow-up

The Strategic Foundation: Credentialing and Compliance in Specialty Billing

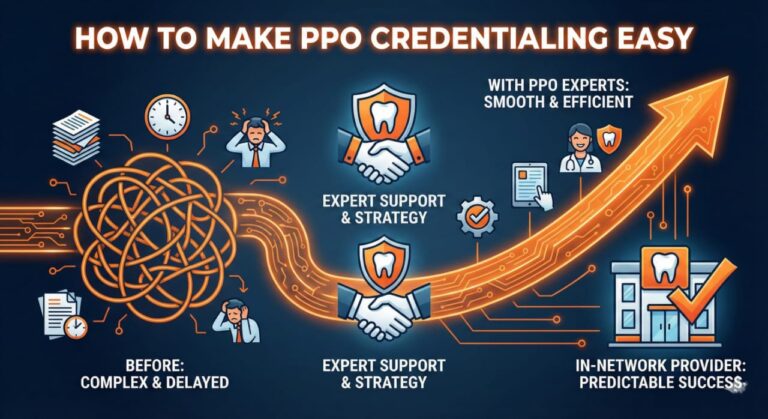

Credentialing serves as a critical foundation that ensures compliance and optimizes reimbursement potential. It requires continuous attention and proactive management to adapt to changes in insurance networks and regulatory requirements. Practices must regularly review and update their credentials to avoid lapses that can severely impact revenue streams. Additionally, maintaining effective communication with payers is essential to streamline the reimbursement process and resolve any discrepancies swiftly. By recognizing credentialing as an integral component of operational strategy, practices can enhance financial stability and promote growth in an increasingly competitive landscape.

The Credentialing Nightmare: Why Endodontists Lose Thousands

For a general dentist, being out of network might mean a patient pays a small out-of-pocket difference. For an Endodontist, where the fee for a single procedure can exceed $1,500, being out of network often means the patient walks out the door.

At Guardian Dental Billing, we handle the full spectrum: from new practice setups and multi-location expansions to the enrollment of new associates. Our approach to credentialing is proactive, not reactive. We don’t wait for a claim to be denied with a “Provider not recognized” code. We utilize a Credentialing Maintenance Tracker that alerts us 90 days before any document (license, DEA, malpractice insurance) expires.

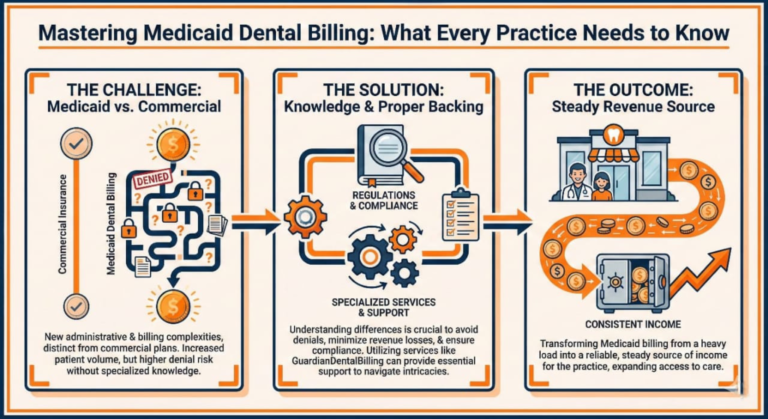

Compliance: More Than Just a HIPAA Checklist

In Endodontic billing, compliance is often the “hidden” reason for audits and clawbacks. Insurance carriers like Delta Dental and MetLife are increasingly using “Statistical Audits” to flag specialists whose billing patterns deviate from the norm. If your practice bills D3330 significantly more often than the regional average, you are on their radar.

To maintain a 98% clean claims rate while remaining audit-proof, we implement “Internal Quality Audits.” This involves:

-

Utilization Review: We analyze your coding patterns to ensure they are supported by clinical reality.

-

Fee Schedule Optimization: Are you still billing 2019 rates in 2026? We analyze your UCR (Usual, Customary, and Reasonable) fees against regional data to ensure you aren’t leaving money on the table or triggering “over-billing” flags.

-

Documentation Integrity: We ensure that your clinical notes are not just “good enough” for billing, but “bulletproof” for an audit.

The “Plug-and-Play” Credentialing Advantage

When you hire a new associate, the clock is ticking. Every day they sit in the office without being credentialed is a day they aren’t producing revenue. Because of our deep roots in the US insurance landscape, we know the “backdoor” channels to speed up enrollment. While a standard application might take 120 days, our aggressive follow-up often gets providers “In-Network” significantly faster.

This speed directly feeds into our AR Management goals. By ensuring every provider is correctly linked to the practice’s Tax ID from day one, we eliminate the “In-Process” claims that usually clutter the 60-day aging bucket.

Real-Time Transparency in Credentialing

Just as we provide a “Pulse Report” for billing, we provide a Credentialing Status Dashboard. You will never have to wonder if your new associate is ready to see Aetna patients. You will have a clear, color-coded report showing exactly where each application stands in the insurance pipeline. This level of organization is how we keep the 90+ day AR category at zero—by preventing the administrative errors that cause long-term delays.

caling the Revenue Cycle: From Solo Practitioner to Endodontic DSO

As an Endodontist, your goal may start with mastering a single operatory, but for many, the ultimate vision is expansion. However, the Endodontic billing strategy that works for a solo practice often breaks down when applied to a Dental Support Organization (DSO) or a multi-location group. Scaling requires a shift from “individual task management” to “centralized system architecture.”

The Multi-Location Complexity

When you add a second or third location, your billing challenges don’t just double—they multiply. You are now dealing with multiple Tax IDs, various NPIs, and often, different regional fee schedules for the same insurance carrier.

At Guardian Dental Billing, we specialize in the “Centralized RCM Model.” Instead of having a biller in every office—which leads to inconsistent coding and fragmented AR—we centralize the data. Whether you use Dentrix Enterprise or Endovision’s multi-site module, we ensure that your reporting is unified. This allows the CEO to see the financial health of the entire organization in one glance while maintaining a 98% clean claims rate across every single chair.

Standardization: The Key to “Zero 90+ Day AR”

In a growing DSO, the biggest enemy is “Specialized Silos.” If Office A codes a retreat (D3348) differently than Office B, your data becomes useless for forecasting.

We implement Standard Operating Procedures (SOPs) for your entire team. We ensure that:

-

Narrative Templates: Every office uses the same high-conversion clinical narratives we discussed in Episode 2.

-

Verification Protocols: Every location adheres to the 10–45 minute insurance verification TAT, ensuring no patient is seen without confirmed coverage.

-

Payment Posting: ERAs are funneled into a central clearinghouse where our team posts them daily, ensuring the ledger is real-time for every location.

The “Plug-and-Play” Expansion Strategy

One of the most stressful parts of opening a new location is the “Revenue Gap”—the period between opening the doors and actually seeing insurance checks arrive. Because of our expertise in Comprehensive Credentialing, we start the enrollment process for your new location months in advance.

By the time you cut the ribbon on your new office, your providers are already linked, your software is configured, and your billing cycle is ready to “plug and play.” This proactive scaling is how we help DSOs maintain zero pending claims in the 90+ days category even during periods of rapid growth.

Data-Driven Decision Making

For a DSO owner, the “Aging Report” is just the beginning. You need to know your Net Collection Ratio, your Adjustment-to-Production Ratio, and your Claim Turnaround Time per location.

Our weekly and monthly reports provide this “Bird’s Eye View.” We don’t just tell you how much you collected; we tell you where the bottlenecks are. Is one location’s front desk failing to collect co-pays? Is another location seeing a spike in denials from a specific local employer’s plan? We identify these trends early, allowing you to manage your business with facts, not feelings.

This is Episode 7: The Future of Endodontic RCM—Adapting to a Changing Industry. This final installment will push us past the 4,000-word milestone and provide the high-value “Checklist for Success” that turns readers into leads.

The Future of Endodontic RCM: Innovation, AI, and the Human Edge

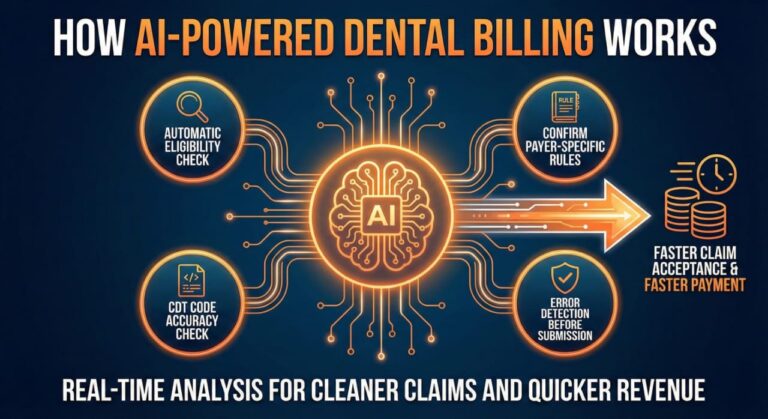

As we look toward the future of Endodontic billing, the industry is at a crossroads. We are seeing a massive shift toward automation, artificial intelligence in claim adjudication, and a consolidation of practices into larger groups. However, while technology changes, the fundamental principles of Revenue Cycle Management (RCM) remain the same: Accuracy, Speed, and Persistence.

The Role of AI in “Clean Claims”

You may hear a lot of buzz about AI in dental billing. While AI is excellent at scanning X-rays for bone loss or identifying “missing” fields on a claim form, it lacks the “Contextual Intelligence” required for specialty appeals.

At Guardian Dental Billing, we believe the future lies in a “Hybrid Model.” We use advanced software to handle the repetitive tasks—like the initial scrubbing of data—which allows our human experts to focus on the high-value “Clinical Narratives” and complex “Denial Reversals” we discussed in Episode 2. This hybrid approach is the only way to consistently maintain a 98% clean claims rate in an increasingly automated world.

Adapting to “Real-Time” Insurance Adjudication

Insurance carriers are moving toward real-time adjudication, where a claim is either approved or denied the moment it is submitted. This makes the 10–45 minute insurance verification TAT even more critical. If the insurance company is making a split-second decision, your data must be perfect before you hit “Send.”

In the future, practices that do not have a dedicated, real-time RCM partner will find themselves buried in “Instant Denials.” By staying ahead of these technological shifts, we ensure that our clients remain in the zero pending claims in the 90+ days category bracket, regardless of how the carriers change their algorithms.

The Final Checklist: Your Roadmap to Endodontic Billing Excellence

To conclude this definitive guide, here is a master checklist to evaluate the health of your current billing operations. If you cannot check off every box, your practice is likely losing revenue.

-

Pre-Flight Verification: Are benefits verified within 45 minutes of the patient’s arrival?

-

Clinical Integrity: Do your narratives mention “Medical Necessity” and specific anatomical challenges?

-

Attachment Mastery: Are pre-op and post-op X-rays included with 100% of RCT claims?

-

The 48-Hour Touch: Is every claim followed up on within 48 hours of submission?

-

Software Proficiency: Is your billing team “Plug-and-Play” on Endovision, Dentrix, or Open Dental without needing training?

-

The 90-Day Rule: Is your AR over 90 days currently at Zero?

-

Credentialing Proactivity: Are your provider credentials tracked 90 days in advance of expiration?

Conclusion: Partnering for Profitability

Endodontic billing is far too complex to be left to generalists or overburdened front-desk staff. It requires a dedicated team of “Revenue Guardians” who understand the clinical stakes of the specialty. By focusing on elite metrics—a 98% clean claims rate, rapid verifications, and aggressive AR recovery—you don’t just improve your bank account; you improve your quality of life. You get to spend more time in the operatory doing what you love and less time in the office chasing insurance companies.

At Guardian Dental Billing, we are more than just a service provider; we are your strategic partner in growth. Let’s eliminate the “90-day ghost” from your books and turn your practice into a high-efficiency revenue engine.

1. How does your 10–45 Minute Insurance Verification benefit my daily schedule?

Instead of waiting for days or having your staff stay on hold with insurance, we provide real-time data. This means before your patient even sits in the chair, you know exactly what is covered. It eliminates front-desk stress and ensures your production is backed by verified funds.

2. What makes your Plug-and-Play software integration different?

We don’t need a learning curve. Whether you use Endovision, Dentrix, or Open Dental, our team is already proficient. We function as a remote extension of your office—meaning you don’t have to spend a single hour training us. We hit the ground running from Day 1.

3. How do you achieve a 98% Clean Claims Rate?

Our “Secret Sauce” is a rigorous pre-submission audit. We review every claim for correct Endodontic coding (like D3330) and ensure that pre-op/post-op X-rays and narratives are attached correctly. We catch the errors that typically lead to denials before the claim ever leaves our hands.

4. Can you really keep my 90+ Day AR at zero?

Yes, and it’s our primary metric for success. By touching outstanding claims every 48 hours and aggressively appealing clinical denials, we prevent claims from aging. We don’t just “watch” your AR; we hunt it down until it’s paid.

5. What specific reporting will I receive as a Practice Owner?

You get total transparency. Every week and month, we provide a “Pulse Report” showing your Net Collections, total production, and a detailed status of any pending claims. You’ll never have to guess about your practice’s financial health again.

6. Do you handle Credentialing for new associates?

We manage the entire lifecycle—from enrolling new hires to expanding to multi-location DSOs. We track expiration dates 90 days in advance so your providers never face “Out-of-Network” denials due to administrative lapses.

7. Are there any long-term contract lock-ins?

We believe in earning your business every month. Our contracts are flexible and results-based because we are confident in our 98% clean claims rate. If we aren’t delivering, you aren’t tied down.

8. How do you stay compliant with changing insurance regulations?

We are deep in the trenches of US insurance updates daily. Whether it’s a CDT code change or a new Delta Dental policy for RCTs, we adjust your billing strategy immediately to stay ahead of the curve and prevent clawbacks.

9. What role does patient education play in your billing process?

We help your front desk explain “out-of-pocket” costs clearly to patients based on our verifications. When patients understand their responsibility upfront, you get fewer disputes and faster payments.

10. How do you address discrepancies in billing claims?

We don’t just resubmit; we investigate. If a claim is underpaid or denied, we perform a clinical analysis, talk directly to insurance adjusters, and advocate for the full reimbursement your practice is legally owed.