In 2025, claim denials remain one of the biggest threats to steady cash flow for healthcare and dental providers. Whether you’re a dental biller, medical billing company, or practice manager, every denied claim represents lost revenue, delayed payments, and extra administrative work.

The best news? Most denials are avoidable. When you focus on proven strategies to reduce claim denials, you not only protect revenue but also streamline operations and ease the stress on your team. This comprehensive guide maps out real-world, evidence-based tactics to reduce claim denials, optimize the billing process, and get paid more quickly.

Why Claim Denials Hurt Your Revenue and Cash Flow in 2025

Denials are more than a nuisance, they are a huge drain on productivity and revenue. Each denial takes time, personnel, and resources to correct, and oftentimes, the payment is never made.

Industry numbers tell a discouraging tale:

- 65% of denials are never resubmitted, so providers lose that money forever.

- It takes $25 to $118 in staff time and administrative assets to rework a denied claim.

- Denials cause 30–90 day payment delays, affecting cash flow and operational stability.

In small to mid-sized practices, repeated denials can snowball into major financial issues, emphasizing the need for denial prevention to be a critical component of revenue cycle management in 2025.

Top Causes of Claim Denials in 2025 That All Practices Should Be Aware Of

Knowing why claims are denied is the first step to cutting them back. In 2025, the most frequent causes are:

1. Incomplete or Incorrect Patient Information

Even minor mistakes, like a misspelling of a person’s name, date of birth inaccuracies, or an older address, will send the claim straight into denial. Insurance programs will automatically reject claims when the demographic information does not correspond with their database. Even a misplaced insurance ID number or a policy number mismatch in some situations leads to claims being rejected and flagged without even considering them. Accuracy at the registration phase is extremely important to prevent rejections unnecessarily.

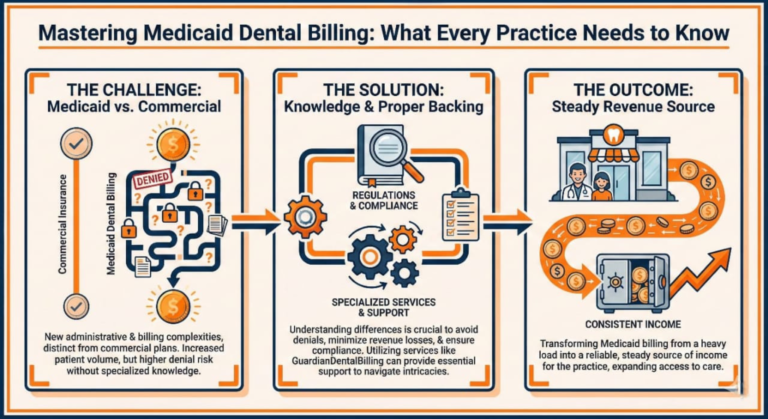

2. Inaccurate or Incomplete Insurance Verification

Not checking coverage status, plan restrictions, or coordination of benefits prior to claim submission leads to automatic rejection. Patients may have changed jobs, switched to a new insurer, or changed plan details without informing the provider. With frequent changes in 2025 and high-deductible health plans, practices that do not verify can expect denials for non-covered or ineligible services.

3. Coding Errors That Lead to Automatic Rejections

Incorrect use of outdated CPT, CDT, or ICD-10 codes, or combination of incorrect procedure and diagnosis codes, can result in automatic denials. Inaccurate coding not only results in delays in payment but also generates compliance issues and encourages audit invitations. Frequent errors include out-of-sync treatment notes and procedure codes or services billed at an inappropriate level. Being current with yearly code revisions is the best way to avoid these pitfalls.

4. Missing or Inadequate Documentation

Lack of adequate supporting records, including X-rays, periodontal charts, or patient narratives, will cause payers to deny claims on the grounds of “lack of medical necessity.” Ambiguous or incomplete notes also compromise appeals, making it difficult to reverse denials. Payors are more tightly scrutinizing claims in 2025, particularly for high-cost or specialty services, so solid documentation is not an option.

5. Late Filing of Claims and Deadlines Missed

There is a filing deadline for every payer that could be as little as 90 days from the date of service. Claims submitted late nearly always get rejected. Practices lose thousands of dollars in revenue annually just because claims were not processed in a timely fashion. Automated reminders and in-house deadlines are established to make sure a claim does not fall through the cracks.

Proven Tactics to Minimize Claim Denials in 2025 and Get Paid Quicker

This is the way high-performing practices maintain low denial rates and get payments sooner.

1. Confirm Patient Insurance Prior to Each Appointment

- Verify active coverage on the appointment day.

- Verify annual maximums, deductibles, waiting times, and frequency of service limitations.

- Utilize online payer portals, same-day eligibility checks, or automated verification software.

Why it matters: Even long-standing patients can have changed plans, which means assumptions can lose you a claim.

2. Enhance Data Entry Accuracy on All Claims

- Double-check patient demographic information prior to claim submission.

- Use electronic intake forms that auto-complete data in order to minimize human mistake.

- Educate staff in frequent data errors and their cost consequences.

Example: One incorrect digit in an insurance ID number can lead to a denial that takes weeks to rectify.

3. Keep Up with Yearly Coding Updates and Compliance Regulations

- Study yearly CDT and CPT updates and implement them instantly.

- Utilize coding crosswalks to align procedures with the right diagnosis codes.

- Avoid upcoding (reporting a higher level of service than was rendered) or downcoding (reporting less than was rendered) that creates compliance hazards.

Why it matters: Coding errors are one of the most frequent, and avoidable, reasons for denials.

4. Affix Mandatory Documentation to Validate Medical Necessity

- Omitting diagnostic images, treatment notes, and narratives for services bound to be challenged by payers virtually guarantees denial.

- In medical-dental cross-coding, verify that ICD-10 diagnosis codes must correspond with CPT or CDT procedure codes.

Example: A claim for periodontal scaling without an accompanying perio chart will probably be rejected.

5. File All Claims Timely and Without Delay

- Implement an internal policy to submit all claims within 24–48 hours of treatment.

- Utilize batch submission systems or real-time electronic data interchange (EDI) for quicker delivery.

Why it matters: The sooner you submit, the less chance you have of missing filing deadlines and the quicker you receive payment.

6. Track and Appeal Denials Promptly With Complete Evidence

- Monitor Explanation of Benefits (EOB) or Electronic Remittance Advice (ERA) on a daily basis.

- Immediately appeal any denied valid claims, providing all supporting documentation.

- Keep denial logs to recognize trends and repeat problems.

Pro tip: Appeals are much more effective when submitted early and with total supporting documentation.

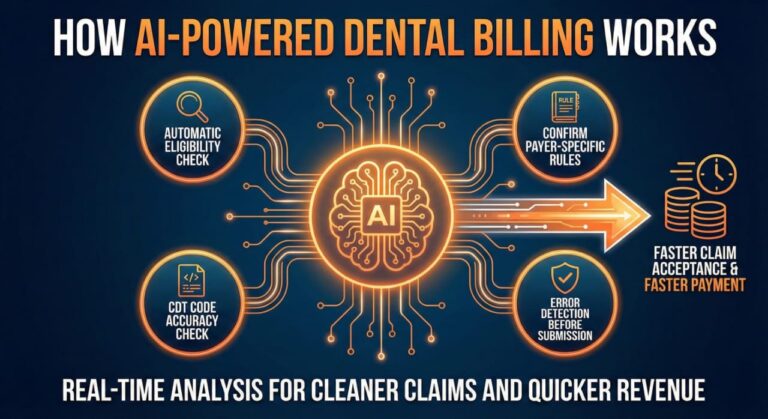

7. Use AI-Powered Claim Scrubbing Tools in 2025

AI-based billing software can identify and flag potential issues prior to claim submission.

Benefits include:

- Much reduced manual review.

- Accelerated claim turnaround.

- Predictive notification of high-risk claims due to payer-specific rules.

Constructing a Step-by-Step Denial Prevention Workflow

A methodical workflow avoids errors falling through the cracks:

- Pre-appointment: Confirm coverage and secure pre-authorizations, if necessary.

- Day of service: Validate patient information and correctly code procedures.

- Claim submission: Employ AI-driven scrubbing software prior to claim transmission.

- Post-submission: Track claim status daily through payer portals.

- Denial follow-up: Appeal in a timely manner with thorough and compliant documentation.

The Staff Training and Education Role in Minimizing Claim Denials

Your billing staff is your frontline defense against denials.

- Quarterly code change, payer requirement, and documentation standard training.

- Develop a written billing guide for quick reference.

- Cross-training employees so no process is slowed because of absences or turnover.

Training enables each team member to confidently prevent, and resolve, claim denials.

The Payoff of Lower Denial Rates for Your Practice

Lowering denials has tangible benefits:

- Increased revenue without more patients.

- Reduced payment cycles, sometimes from months to weeks.

- Greater productivity by avoiding rework.

- Improved patient relationships through clear, precise billing.

Last Thoughts: Constructing a Prevention-First Strategy for Claim Denials in 2025

In 2025, minimizing claim denials isn’t merely about repairing issues once they arise, but rather constructing a prevention-first approach. With the integration of proper insurance verification, proper documentation, current coding, employee training, and AI-based tools, you can significantly reduce your rates of denial, enhance cash flow, and maintain your practice fiscally strong.

Reducing claim denials in 2025 requires developing a prevention-first strategy rather than just fixing problems after they occur. You can drastically lower your denial rates, improve cash flow, and keep your practice financially sound by combining appropriate insurance verification, appropriate documentation, up-to-date coding, staff training, and AI-based technologies.

To stay in line with regulations, check out the HIPAA Learning Academy for additional compliance insights.

Check out our Guardian Dental Training programs if you’re looking for specific industry training and billing assistance. They’re made to help your team become proficient in revenue cycle management and denial prevention.