https://www.opendental.com/If you’re working as a remote dental biller — or planning to become one — there’s one task you absolutely cannot afford to mess up: dental claim submission.

You may be working from home in comfortable clothes, but your responsibility is just as serious as someone sitting at the front desk of a dental office. Every claim you submit directly affects whether the practice gets paid on time or ends up chasing insurance companies for weeks.

In this guide, you’ll learn how to submit dental claims correctly as a remote dental biller, avoid unnecessary rejections, and become the kind of biller every dental office trusts.

Why Dental Claim Submission Is More Than Just Data Entry

At first glance, claim submission might look simple. Fill out the form. Click submit. Done.

In reality, it’s much more than that.

As a remote dental biller, your work impacts three critical areas:

-

Insurance accuracy – verifying that coverage is active and benefits are available

-

Coding accuracy – selecting correct CDT (and ICD-10 when needed) codes

-

Payment flow – helping the dental office get paid faster with fewer denials

Because you’re working remotely, accuracy matters even more. You don’t have the luxury of quickly asking someone across the room — everything has to be right the first time.

Step-by-Step: How to Submit Dental Claims from Home

Let’s walk through the exact process you should follow when submitting dental claims remotely.

Step 1: Always Verify Insurance First

Before any treatment is billed, insurance verification must be done.

Never rely only on what’s already in the system. Log into the insurance portal or call the payer directly to confirm:

-

Is the insurance plan active?

-

Has the annual maximum been used?

-

Is there a waiting period for the procedure?

-

Does the plan cover out-of-network providers?

Document everything clearly in the patient’s chart. Proper insurance verification prevents surprises, delays, and denied claims later.

Step 2: Collect All Required Information

Submitting a clean dental claim requires more than basic patient details.

Before creating the claim, confirm that you have:

-

Dentist’s NPI and Tax ID

-

Accurate CDT procedure codes

-

Tooth numbers and surfaces (when applicable)

-

Correct date of service

-

Required attachments such as X-rays or narratives

Even a small typo can cause a rejection. Insurance companies are strict — and they don’t make exceptions.

Step 3: Use the Correct Dental Codes (Never Guess)

Coding mistakes are one of the biggest reasons dental claims get denied.

Each procedure must be billed using the most current CDT code. Some claims — especially medical cross-coding — may also require ICD-10 diagnosis codes.

-

Always use the latest code set

-

Apply modifiers only when required

-

Never guess a code

Incorrect codes lead to denials, delayed payments, and rework that could have been avoided.

Step 4: Complete the Claim Carefully

Most dental claims are submitted electronically through practice management software or a clearinghouse.

Before submitting, double-check:

-

Patient and insurance information

-

Provider details

-

Procedure codes and fees

-

Attachments such as X-rays, narratives, or perio charts

Automation helps, but it doesn’t replace careful review. Even with systems like Open Dental, Dentrix, or Curve Dental, accuracy is still your responsibility.

Example of a Strong Narrative:

Crown recommended on tooth #30 due to fractured cusp and decay under existing restoration. Patient reports sensitivity. Fracture visible on bitewing X-ray.

Clear, concise, and medically relevant — exactly what insurance reviewers want.

Step 5: Submit and Track Every Claim

Submitting a claim is not the final step.

After submission, record:

-

Submission date

-

Claim or batch number

-

Expected response time

Use a tracking system — whether built into your software or a simple Excel or Google Sheet — with columns for:

-

Patient name

-

Date of service

-

Submission date

-

Claim status

-

Payment or denial notes

Tracking keeps you organized and makes follow-ups easier.

Step 6: Follow Up Professionally

Even perfectly submitted dental claims can get delayed.

Follow up when:

-

There’s no response after 2–3 weeks

-

A claim is rejected without a clear reason

-

Insurance claims they never received it

When calling insurance, always document:

-

Representative’s name

-

Reference number

-

Call details

This level of documentation builds trust with dental offices and shows professionalism.

Common Dental Claim Submission Mistakes Remote Billers Must Avoid

Even experienced remote dental billers make mistakes. The difference between an average biller and a highly trusted remote dental biller is how often those mistakes happen — and how quickly they’re prevented.

Here are the most common dental claim submission errors you must avoid.

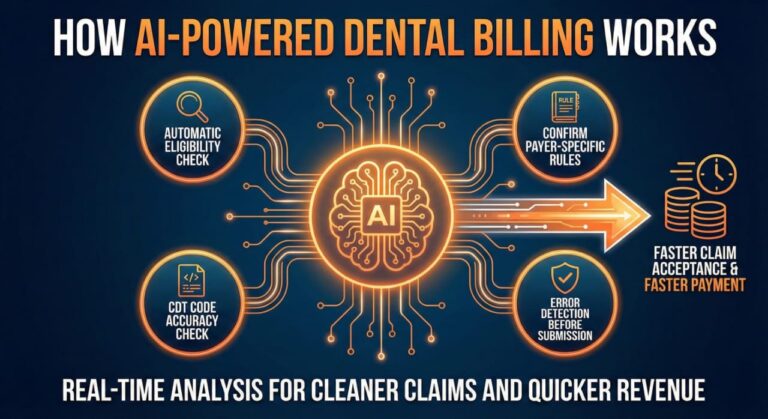

Using Outdated CDT Codes

CDT codes change every year. Submitting claims with old codes is a guaranteed way to get denied.

Always:

-

Use the latest CDT code set

-

Review code updates annually

-

Confirm payer-specific rules

Old codes = automatic rejections.

Missing Required Attachments

Many procedures require supporting documents, such as:

-

Crown X-rays

-

SRP perio charting

-

Narratives for major treatment

If attachments are missing, the claim will sit unpaid — or get denied outright.

Incorrect Insurance Details

One wrong digit in:

-

Policy number

-

Group number

-

Payer ID

…and the claim fails.

As a remote dental biller, you must double-check insurance details before submitting every claim.

Late Claim Submission

Most insurance companies have a 90-day filing limit.

Miss that window, and:

-

The claim becomes non-payable

-

Appeals are often rejected

-

The office loses revenue

Timely submission is not optional — it’s critical.

Best Tools for Remote Dental Claim Submission and Management

Successful remote dental billing depends heavily on the right tools. These aren’t luxuries — they’re essentials.

| Tool | Purpose |

|---|---|

| Practice Management Software (Open Dental, Dentrix, Eaglesoft, Curve) | Claim creation and patient data |

| Clearinghouses (DentalXChange, Vyne) | Electronic claim submission and tracking |

| Insurance Portals (MetLife, Aetna, Guardian, Delta Dental) | Eligibility and claim follow-up |

| Google Sheets / Excel | Manual claim trackers and audit logs |

| PDF & Imaging Tools | Compress X-rays and attach narratives |

Using these tools properly allows you to submit clean dental claims faster and more accurately.

How to Stand Out in Remote Dental Billing Jobs

Remote dental billing is competitive. To succeed, you must offer more than just basic claim submission.

Dental offices value remote billers who:

-

Submit clean claims the first time

-

Follow up consistently

-

Communicate clearly

-

Maintain HIPAA compliance

-

Reduce denials and delays

You may not be physically in the office, but your work quality speaks louder than presence.

Where to Find Legit Remote Dental Billing Jobs

If you’re building experience or expanding your client base, start with trusted platforms:

-

DentalPost.net

-

Indeed.com (search “remote dental biller”)

-

Facebook groups focused on dental billing jobs

-

Upwork & Fiverr (start small and build credibility)

What Clients Look for in a Remote Dental Biller

Dental offices want reliability.

They look for:

-

Experience with their practice software

-

Strong claim submission and follow-up skills

-

Organized work habits

-

Clear communication

-

Consistent performance

When you meet these expectations, referrals follow naturally.

Remote Dental Claim Submission FAQs

What is a dental claim and why is it important?

A dental claim is a request sent to an insurance company for payment. Accurate claim submission ensures faster reimbursement and fewer denials.

Can dental billers work remotely?

Yes. With proper training, secure software access, and strong communication skills, many dental billers work entirely from home.

What information is required to submit a dental claim?

Patient demographics, insurance details, provider information, CDT codes, treatment dates, and necessary attachments.

How long does claim processing take?

Most electronic dental claims are processed within 7–21 business days, depending on the insurance carrier.

Why do dental claims get denied?

Common reasons include incorrect codes, missing attachments, inactive insurance, late submission, or lack of medical necessity documentation.

Final Thoughts: Why Clean Claim Submission Builds Your Reputation

You may never wear scrubs or greet patients, but you are the reason dental offices get paid.

Every clean claim you submit strengthens your reputation as a reliable remote dental biller. Over time, that reputation leads to:

-

Better clients

-

Stable income

-

Long-term work opportunities

Accuracy, consistency, and follow-up turn remote billing into a powerful and trusted career.

How to Reduce Dental Claim Denials as a Remote Dental Biller

If you want long-term success in remote dental billing, your main goal should be simple:

submit fewer claims — but get paid on more of them.

Here’s how professional remote dental billers consistently reduce denials.

Create a Claim Submission Checklist

Never rely on memory. Use a checklist for every claim:

-

Insurance verified and documented

-

Correct CDT (and ICD-10 if needed)

-

Tooth numbers and surfaces entered

-

Attachments added

-

Fees and provider details reviewed

Checklists turn accuracy into a habit.

Stay Updated With Insurance Rules

Insurance policies change quietly.

As a remote dental biller, you should:

-

Review payer newsletters

-

Track common denial reasons

-

Maintain notes by insurance carrier

Knowing payer behavior helps you submit clean claims the first time.

Audit Your Own Claims Weekly

Take time each week to:

-

Review paid claims

-

Analyze denied claims

-

Identify patterns

If the same mistake appears twice, fix the process — not just the claim.

HIPAA Compliance for Remote Dental Claim Submission

Working remotely does not reduce your HIPAA responsibility.

In fact, it increases it.

To stay compliant:

-

Use secure Wi-Fi

-

Avoid public computers

-

Lock your screen when away

-

Never share login credentials

-

Store files securely

Dental offices trust remote billers with sensitive patient data. Protecting that trust is non-negotiable.

How Dental Offices Measure a Remote Dental Biller’s Performance

Dental practices don’t judge you by how busy you look.

They judge you by results.

Key performance indicators include:

-

Denial percentage

-

Average payment turnaround time

-

Quality of follow-up notes

-

Communication consistency

Strong performance keeps clients long-term.

https://www.cms.gov/

Building a Long-Term Career in Remote Dental Billing

Remote dental billing isn’t a side gig when done right.

It’s a stable, scalable career.

To grow:

-

Master claim submission and follow-ups

-

Learn multiple PMS platforms eg. Dentrix Ascend, open Dental, CareStack and EagleSoft

-

Specialize in high-value procedures (crowns, implants, SRPs)

-

Offer reporting and insights, not just billing

Specialized billers earn more and face less competition.

Quick Links

-

HIPAA compliance training page

-

Remote dental billing jobs resource

Final Conclusion: Why Claim Submission Defines You as a Remote Dental Biller

You may work from home.

You may never step inside the dental office.

But your work controls the cash flow.

Every accurate claim submission builds confidence.

Every proper follow-up builds trust.

Every clean claim builds your reputation.

When dental offices know their revenue is safe with you, they don’t replace you — they recommend you.

That’s how you win in remote dental billing.

Quick Recap: How to Submit Dental Claims as a Remote Dental Biller

-

Verify insurance every time

-

Use updated CDT codes

-

Attach required documentation

-

Track and follow up consistently

-

Communicate professionally

Do these well, and you’ll always stay in demand.